Generic Price Transparency: Tools to Find the Best Price for Prescription Medications

How much should you really pay for a generic pill? If you’ve ever been handed a prescription and then shocked by the price at the pharmacy, you’re not alone. A 2025 study found that nearly 4 in 10 Americans skipped or delayed filling a generic prescription because of cost. The problem isn’t just high prices-it’s that the prices are hidden until the last minute. You don’t know what you’re going to pay until you’re standing at the counter, holding your prescription, and your card gets declined. That’s where price transparency tools come in. They’re not magic, but they can save you hundreds a year-if you know how to use them.

Why Generic Drug Prices Vary So Much

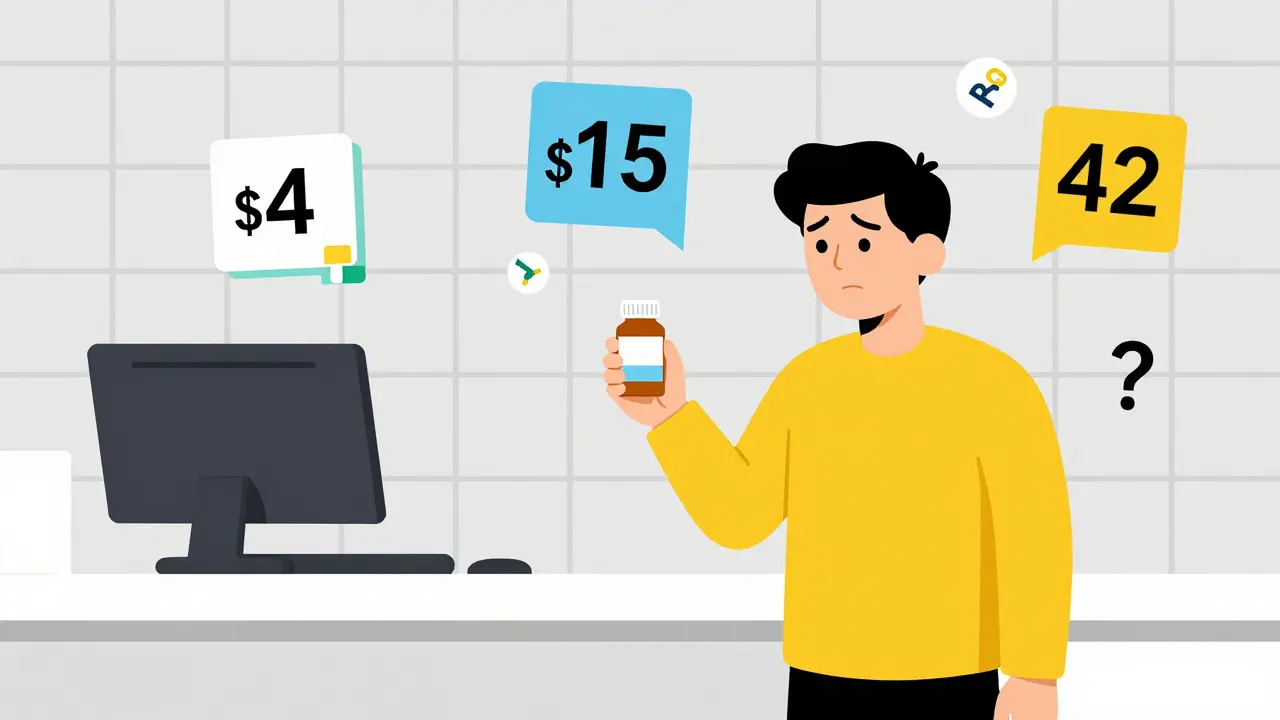

Two identical bottles of metformin, side by side at two different pharmacies, can cost $4 and $42. That’s not a mistake. It’s the result of a broken system. The list price you see on a drug manufacturer’s website-called the Wholesale Acquisition Cost, or WAC-is rarely what anyone actually pays. Pharmacies, insurers, and pharmacy benefit managers (PBMs) negotiate secret discounts and rebates behind the scenes. What you pay is based on your insurance plan’s contract with the PBM, the pharmacy’s agreement with the PBM, and whether the pharmacy is even part of your network.

For example, a 30-day supply of lisinopril might have a WAC of $12. But your insurer might have negotiated a net price of $2. The pharmacy gets reimbursed $2 by your plan, but if you’re paying cash, the pharmacy might charge you $15 because they don’t get the rebate. Meanwhile, another pharmacy might have a deal with a different PBM that lets them sell it for $4. There’s no single price. There’s no standard. And until recently, you had zero way to know which pharmacy had the best deal for you.

Real-Time Benefit Tools: What Doctors Use

Since 2020, federal rules have pushed for real-time price visibility at the point of care. That’s where Real-Time Benefit Tools (RTBTs) come in. These are systems built into electronic health records like Epic and Cerner. When your doctor types in a prescription, the system checks your insurance plan and shows you exactly what you’ll pay out of pocket-for that pharmacy, right now.

Tools like CoverMyMeds and Surescripts connect directly to your insurer’s database. They don’t guess. They pull your actual copay, deductible status, and formulary rules. If a cheaper generic alternative exists, the tool will suggest it. One physician in Ohio reported cutting his patients’ out-of-pocket costs by 37% just by switching to lower-cost generics that were still covered. That’s not theory-it’s happening in clinics right now.

But here’s the catch: RTBTs only work if your doctor uses them. As of 2025, only 42% of independent physician practices have fully integrated these tools. Large hospital systems are ahead-78% use them-but most small clinics still rely on paper forms or phone calls to the pharmacy. If your doctor doesn’t use a real-time tool, you’re flying blind.

Apps Like GoodRx: What Patients Use

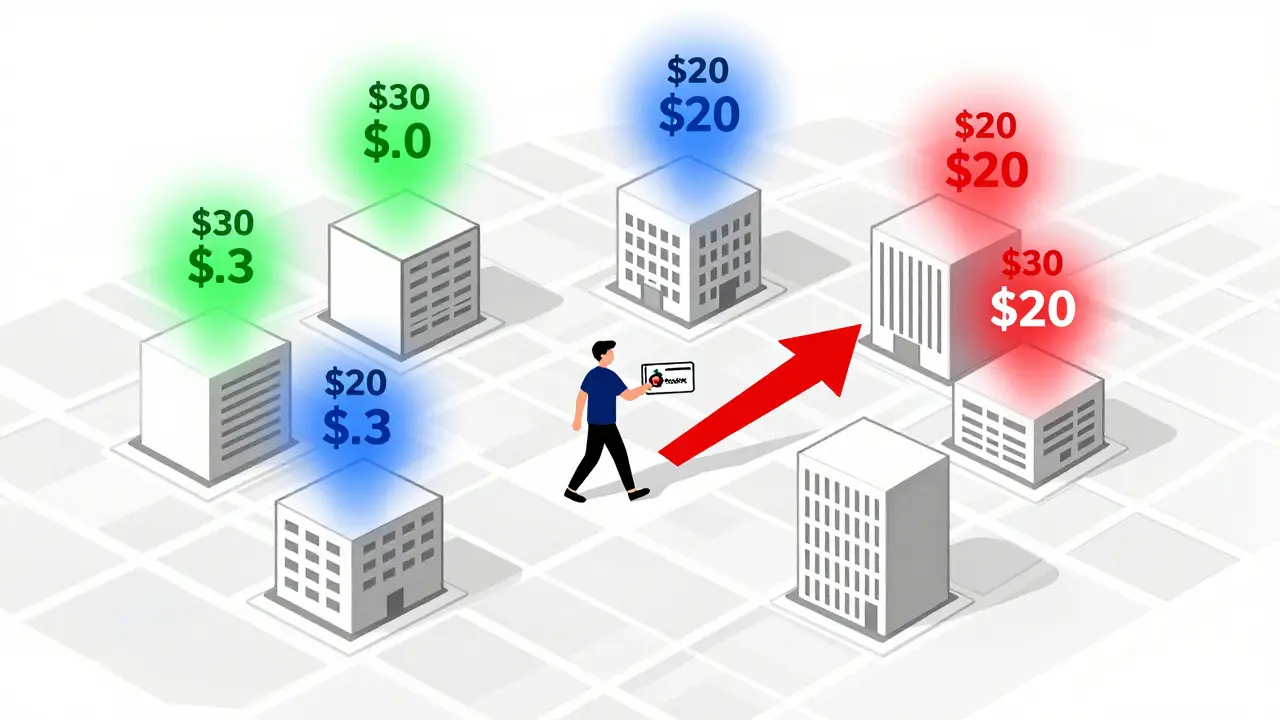

While doctors use RTBTs, patients use apps like GoodRx, SingleCare, and RxSaver. These tools scan prices across thousands of pharmacies nationwide and show you the lowest cash price for your drug-no insurance needed. In 2024, 43% of U.S. pharmacies accepted GoodRx coupons. That’s a lot.

GoodRx isn’t insurance. It’s a discount card. You print it, show it at the counter, and pay the discounted price. For many generics, it’s cheaper than your insurance copay. A 30-day supply of atorvastatin might cost $18 with insurance but only $6 with GoodRx. That’s why 1.2 million people use RxAssist and similar services every year to find free or low-cost medications.

But don’t trust the app blindly. A 2025 Trustpilot review found that 1 in 5 users were told the price was wrong when they arrived at the pharmacy. Why? Because pharmacies update their prices manually, and sometimes the app’s data is 24-48 hours old. Always call ahead. Ask: “Is this price still valid today?”

State Laws Are Changing the Game

Some states are forcing transparency. California requires drugmakers to report price hikes over 16% in two years. Minnesota lets patients check a public portal that shows price differences between nearby pharmacies. One patient there saved $287 a year just by switching to a pharmacy 3 miles away.

Twelve states now have Prescription Drug Affordability Boards (PDABs) that review drug prices and set upper limits. These boards don’t control prices directly, but they can force manufacturers to justify hikes or face penalties. In 2025, Minnesota passed a law that capped price increases on generic drugs and required manufacturers to disclose their net prices to the state-something the federal government still won’t require.

These laws are slow to roll out. But they’re changing how pharmacies operate. If your state has a transparency law, check your health department’s website. You might have access to a free tool that shows you the lowest price within a 10-mile radius.

The Big Missing Piece: Net Prices Are Still Hidden

Here’s the harsh truth: even the best tools don’t show you the full picture. All of them-RTBTs, GoodRx, state portals-only show you the wholesale price, not the net price after rebates. That’s the real cost. The drugmaker gives the PBM a rebate of $8 per pill. The PBM keeps $6 and passes $2 to the insurer. You never see that. So you think $4 is cheap. But the real cost to the system is $4 minus $8. That’s a loss. And that’s why prices keep rising.

Experts like Dr. Dan Arnold from Avalere Health say: “Transparency without net price disclosure is just noise.” It helps you pick a cheaper pharmacy, but it doesn’t fix the system. The rebates create perverse incentives. Pharmacies and PBMs profit more when prices are high because rebates are tied to list prices. So the system rewards expensive drugs-even when cheaper ones work just as well.

How to Use These Tools in 3 Steps

- Before your appointment: Look up your prescription on GoodRx or SingleCare. Note the lowest cash price.

- During your appointment: Ask your doctor: “Can you check the real-time cost through your system?” or “Is there a generic alternative that’s cheaper?”

- At the pharmacy: Ask for the cash price. Then ask if they accept GoodRx. If the cash price is lower than your copay, pay cash. Don’t use insurance.

Pro tip: Some pharmacies charge more for insurance than for cash. That’s not a typo. It’s because insurance processing fees cost the pharmacy money. Paying cash avoids those fees. Always ask.

When Tools Don’t Work-What to Do

Not every drug has a good price option. Specialty generics for rare conditions can still cost $500 a month. If your drug isn’t on any discount app:

- Check RxAssist.org. It lists manufacturer assistance programs. You might qualify for free medication if your income is under $60,000.

- Call the drugmaker’s patient support line. Many offer co-pay cards or free samples.

- Ask your pharmacist if there’s a therapeutic alternative. Sometimes a different generic brand works just as well.

And if your doctor won’t use a real-time tool? Politely ask them to. Say: “I want to make sure I’m not overpaying. Can we check the cost before I leave?” Most will comply.

The Future: Will Prices Ever Be Fair?

The Drug-price Transparency for Consumers Act of 2025 (S.229) would force drug ads to show the wholesale price. That’s a start. But until rebates are made public, we’re just rearranging deck chairs on the Titanic. The real fix? Ending the rebate system entirely. But that’s years away.

For now, your power is in knowing your options. You don’t need to be an expert. You just need to ask the right questions. Check the price before you fill. Compare. Pay cash if it’s cheaper. Use discount cards. Talk to your pharmacist. These small steps add up. One person saving $300 a year on metformin isn’t a revolution. But 10 million people doing it? That’s how markets change.

Are generic drugs always cheaper than brand-name drugs?

Yes, generics are almost always cheaper because they don’t require expensive clinical trials. But not always cheaper than your insurance copay. Sometimes, the cash price with GoodRx is lower than your insurance copay. Always check both.

Can I use GoodRx with Medicare?

No. Medicare Part D plans are legally required to accept only their own formulary prices. GoodRx coupons can’t be used with Medicare. But you can still use GoodRx to compare prices and pay cash if it’s cheaper than your Medicare copay. Just don’t submit it to Medicare.

Why does the pharmacy say the GoodRx price isn’t valid?

Prices change daily. GoodRx pulls data from pharmacies, but not all update in real time. Some update weekly. Call the pharmacy before you go and say, “I’m showing a $5 price on GoodRx-is that still good today?” If they say no, ask for their lowest cash price. Sometimes it’s even lower.

Do all pharmacies accept discount cards?

No. Most major chains like CVS, Walgreens, and Walmart do. But smaller independent pharmacies may not. Always check the app’s map to see which locations accept the card before you go. Some apps let you filter by “accepts discount cards.”

Is it better to pay cash or use insurance for generics?

It depends. For many generics, cash with GoodRx is cheaper than your insurance copay. For others, insurance gives you a better deal. Always compare both. If your deductible hasn’t been met, paying cash might save you more. If you’ve already met your deductible, insurance might be better. Check both before you pay.

Elaine Douglass

December 18, 2025 AT 23:28I used to pay $45 for my metformin until I found GoodRx. Now I pay $7. I didn’t even know this was a thing until my cousin told me. My pharmacist laughed when I showed him the coupon. Said he’s seen it before but most people just pay and leave. You don’t have to be a genius to save money. Just ask.

Takeysha Turnquest

December 20, 2025 AT 00:46The system is rigged. They want you to suffer quietly. Prices jump like stock market bets. The real cost? Zero. The price you pay? A tax on being sick. They don’t care if you eat ramen for a month. They care about the rebate. The rebate is the real drug. The pill? Just the wrapper.

Emily P

December 21, 2025 AT 11:25So if net prices are hidden, how do we know if the $4 price is actually better than the $18 insurance copay? Is the $4 the net price or the gross? And if the rebate is $8 per pill, why isn’t that reflected anywhere? I feel like I’m playing a game where the rules change every round.

Vicki Belcher

December 21, 2025 AT 20:09YESSSS this is life-changing 💪💖 I just saved $212 on my blood pressure med this month!!! I didn’t even know I could pay cash and beat my insurance. My pharmacist was so nice she even printed me a little cheat sheet 🙌 Thank you for this post - you just made my year 😭❤️

Aboobakar Muhammedali

December 23, 2025 AT 08:16I live in India and we have no such system. My wife’s diabetes meds cost $2 here. Same pill. Same factory. But in the US? $40. I don’t get it. Why do you let them do this? You have power. Use it. Don’t just complain. Ask for the cash price. Always.

Laura Hamill

December 25, 2025 AT 07:15GoodRx is a government trap. They want you to think you’re saving money but they’re just making you pay cash so they don’t have to report it. The IRS knows. The PBMs know. The drug companies know. You think you’re fighting the system? You’re just feeding it. They want you to be confused. They want you to jump through hoops. Don’t fall for it.

Sahil jassy

December 27, 2025 AT 06:40Try calling 3 pharmacies before you go. Always. I did this for my dad’s cholesterol pill. One said $12. Another said $5. Third said $3.50 with a coupon. I drove 10 miles. Worth it. Small effort. Big savings. You got this 💪

Kathryn Featherstone

December 28, 2025 AT 12:58One thing I’ve learned: always ask your pharmacist if they have a loyalty program. Some independent pharmacies offer discounts if you fill all your scripts there. It’s not advertised. But if you ask nicely, they’ll tell you. I saved $80 last year just by asking.

Nicole Rutherford

December 30, 2025 AT 04:14You people are so naive. You think GoodRx is helping? It’s a distraction. The real problem is the FDA allowing generics to be made in China with unregulated ingredients. You’re saving $30 but you’re poisoning yourself. Read the labels. Look at the manufacturer. Most of these "cheap" pills are made in places with no safety standards.

Chris Clark

December 31, 2025 AT 23:58funny thing - i used goodrx for my asthma inhaler and it was cheaper than my insurance. but when i asked my doc to use the real-time tool, he said "oh we don’t use that" and handed me a paper script. i had to google it myself. why do docs still use paper? it’s 2025. also i think they just don’t wanna be bothered.

William Storrs

January 1, 2026 AT 05:24Don’t let anyone tell you this is too hard. You’re not powerless. You’re not a victim. You’re a smart person who just didn’t know the rules. Now you do. Go to the pharmacy. Ask for cash price. Use the coupon. Walk out with your meds and your wallet intact. You did it. Keep going. You’re not alone in this.