Regulatory Exclusivity: Understanding Non-Patent Market Protections in Pharmaceuticals

When a new drug hits the market, patents often get all the attention. But there’s another layer of protection that’s just as important - regulatory exclusivity. This isn’t about patents; it’s a government-granted delay on generic competition that kicks in automatically upon approval. Let’s break down how this works and why it matters.

Regulatory exclusivity A government-granted market protection for pharmaceutical products that operates independently from patent protection. Unlike patents, which require active enforcement by the patent holder, regulatory exclusivity is automatically granted upon drug approval by agencies like the FDA. As the FDA explains, it creates "certain delays and prohibitions on approval of competitor drugs available under the statute that attach upon approval of a drug application."What Drives Regulatory Exclusivity?

Imagine developing a new drug. It takes 10-15 years and $2.6 billion on average to bring it to market. By the time it gets FDA approval, patents might have only 5-7 years left before expiration. Without regulatory exclusivity, competitors could rush in immediately, killing the innovator’s chance to recoup costs. That’s why laws like the Hatch-Waxman Act of 1984 and Orphan Drug Act of 1983 were created. These laws ensure innovators get meaningful commercial time even if patents expire during development.

Here’s the key difference: patents protect specific inventions (like a drug’s chemical formula), while regulatory exclusivity protects the drug product itself. If a patent expires but exclusivity is still active, the FDA can’t approve generics. For example, Humira’s patent expired in 2016, but its 12-year biologics exclusivity delayed biosimilar competition until 2023, generating $19.9 billion in U.S. sales that year.

Types of Regulatory Exclusivity and How They Work

The FDA grants several types of exclusivity, each with specific rules:

- New Chemical Entities (NCEs): 5 years of protection. During the first 4 years, the FDA can’t even accept generic applications. Full approval waits until year 5. This covers most small-molecule drugs.

- Biologics: 12 years under the Biologics Price Competition and Innovation Act (BPCIA) of 2009. This applies to complex therapies like monoclonal antibodies. For instance, Humira qualifies under this.

- Orphan Drugs: 7 years for drugs treating rare diseases affecting fewer than 200,000 Americans. To qualify, sponsors must prove rarity. A drug for a genetic disorder affecting 150,000 people qualifies; one for diabetes does not.

- New Clinical Investigations: 3 years for new uses of existing drugs. If a drug originally approved for cancer is later approved for heart disease, this exclusivity kicks in.

The FDA’s Purple Book database tracks all these exclusivity periods. It’s updated weekly and shows which drugs are protected and when protections expire. Industry analysts confirm 88% of new drugs approved between 2018-2023 qualified for at least one exclusivity type.

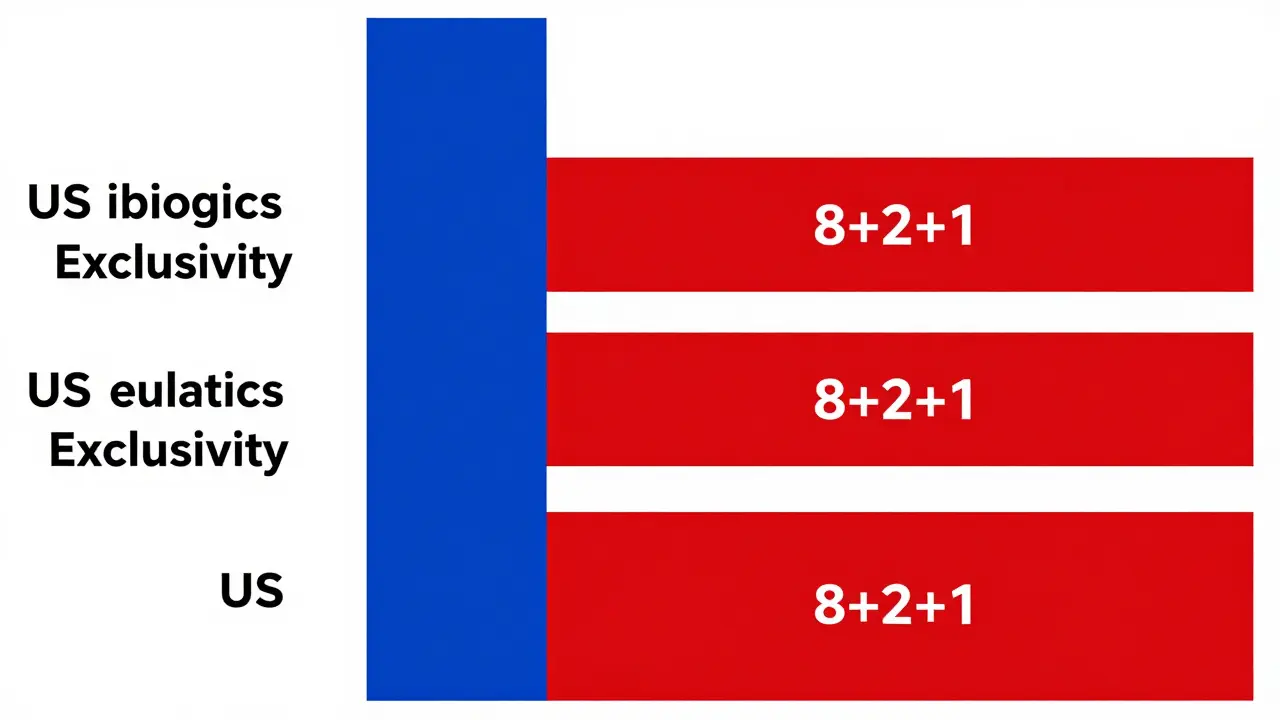

U.S. vs. EU Regulatory Exclusivity: Key Differences

| Exclusivity Type | United States | European Union |

|---|---|---|

| New Chemical Entity (NCE) | 5 years | 8 years data exclusivity |

| Biologics | 12 years | 8+2+1 rule (8 data, 2 market, +1 for new indications) |

| Orphan Drugs | 7 years | 10 years market exclusivity |

| New Clinical Investigations | 3 years | Not applicable |

The EU’s "8+2+1" rule means generic manufacturers can’t reference originator data for 8 years, can’t market generics for 2 years after that, and get a 1-year extension for new indications. Meanwhile, U.S. biologics get a flat 12 years. This creates different competitive landscapes. For example, a biologic approved in the EU in 2020 faces generic competition in 2030, but in the U.S., it’s protected until 2032.

Economic Impact: How Exclusivity Shapes Drug Prices

Regulatory exclusivity directly drives drug pricing. IQVIA data shows drugs with active exclusivity command 3.2x higher prices than generic equivalents. In 2024, the global pharmaceutical market hit $1.42 trillion, with originator drugs making up 68% of revenue. Pfizer alone earned $52.3 billion in 2023 from exclusivity-protected products.

But there’s debate. Public Citizen argues extended exclusivity periods contribute to unsustainable drug pricing. A 2022 analysis by Peter Maybarduk states, "Extended regulatory exclusivity delays generic competition beyond what’s necessary for innovation incentives." Meanwhile, originator companies say it’s essential for recouping R&D costs. Industry surveys show 89% of innovator companies view exclusivity as critical, while 68% of generic manufacturers call it "excessively long," especially for biologics.

Current Changes and Future Trends

Regulatory exclusivity is evolving. The FDA’s 2024 draft guidance on "Exclusivity Period Calculations for Combination Products" addresses complexities in multi-drug therapies. Congressional bills like H.R. 3013 aim to reduce biologics exclusivity from 12 to 10 years, but industry lobbying has stalled progress. The EU’s 2023 pharmaceutical strategy proposes cutting data exclusivity from 8 to 6 years to speed up generic entry.

Experts predict shifts. Tufts Center for Drug Development forecasts combined patent and exclusivity periods will drop from 12.3 to 10.8 years by 2030 due to policy changes. However, biologics will likely keep longer protections. The FDA’s Drug Competition Action Plan 2024-2026 explicitly targets "modernizing exclusivity frameworks to balance innovation incentives with timely generic competition."

Practical Realities for Industry Players

Managing exclusivity isn’t simple. A senior regulatory affairs manager at a major pharma company shared on Reddit: "NCE exclusivity is our most reliable protection - unlike patents which get challenged in court, the FDA simply won’t approve generics during the 5-year window." But generic developers face hurdles too. One generic developer noted, "The 4-year submission barrier for NCEs forces us to start development blind, increasing risk and costs."

Companies need dedicated exclusivity managers. Excelon IP reports 73% of major pharma firms hire specialists to track global expiration dates. It takes 150-200 hours per product during approval to map exclusivity timelines. Missteps can cost millions; for example, missing a 3-year exclusivity window for a new indication could let competitors jump in early.

Frequently Asked Questions

What’s the difference between patent protection and regulatory exclusivity?

Patents protect specific inventions (like a drug’s chemical formula) and require active enforcement by the patent holder. Regulatory exclusivity is automatically granted upon FDA approval and blocks generic approval during the exclusivity period. For example, a drug’s patent might expire in 2025, but regulatory exclusivity could extend until 2030, preventing generics even after patent expiry.

How long does orphan drug exclusivity last?

In the U.S., orphan drug exclusivity provides 7 years of market protection for drugs treating rare diseases affecting fewer than 200,000 Americans. In the EU, it’s 10 years of market exclusivity. This protection applies regardless of patent status and prevents competitors from marketing the same drug for the same rare condition.

Can a drug have multiple types of exclusivity?

Yes. For example, a new biologic for a rare disease could qualify for both 12-year biologics exclusivity and 7-year orphan drug exclusivity. When multiple exclusivities apply, the longest period takes effect. The FDA’s Drug Competition Action Plan notes 88% of new drugs approved between 2018-2023 qualified for at least one exclusivity type.

What happens when regulatory exclusivity expires?

Once exclusivity ends, generic or biosimilar manufacturers can submit applications. However, patent protection may still apply. For instance, Humira’s biologics exclusivity expired in 2023, but patent litigation delayed biosimilars until later that year. The FDA’s Purple Book database tracks exclusivity expiration dates to help stakeholders plan.

Are there efforts to change regulatory exclusivity periods?

Yes. The FDA’s 2024 draft guidance addresses complexities in multi-component therapies. Proposed legislation like H.R. 3013 seeks to reduce biologics exclusivity from 12 to 10 years. The EU’s 2023 pharmaceutical strategy aims to cut data exclusivity from 8 to 6 years. Industry surveys show 68% of generic companies consider current periods "excessively long," while 89% of originator companies view them as essential for recouping R&D investments.