Using Copay Cards Safely: Access Without Compromising Care

Copay Card Impact Calculator

Your Copay Card Details

How This Affects You

When you’re on a specialty medication that costs thousands a month, a copay card can feel like a lifeline. You swipe it at the pharmacy, pay $10 instead of $7,000, and breathe easy. But here’s the catch: that $10 payment might not be helping you get closer to hitting your insurance deductible. And when the card runs out, you could be stuck with a bill you never saw coming.

What Copay Cards Actually Do

Copay cards are offered by drug manufacturers to help commercially insured patients afford high-cost medicines-like those for multiple sclerosis, rheumatoid arthritis, or cancer. These cards cover part of your copayment, so you pay less out of pocket each time you refill. For many, it’s the only way to stay on treatment. According to the National Multiple Sclerosis Society, 72% of specialty drugs now come with this kind of assistance. A 2023 NIH study found that 93% of patients using these cards felt they made a real difference in sticking with their treatment. But here’s the thing: copay cards don’t work for everyone. They’re only available to people with private insurance. If you’re on Medicare or Medicaid, you can’t use them. Federal law blocks drug companies from giving financial help to government program enrollees to avoid kickback violations.The Hidden Trap: Copay Accumulator Programs

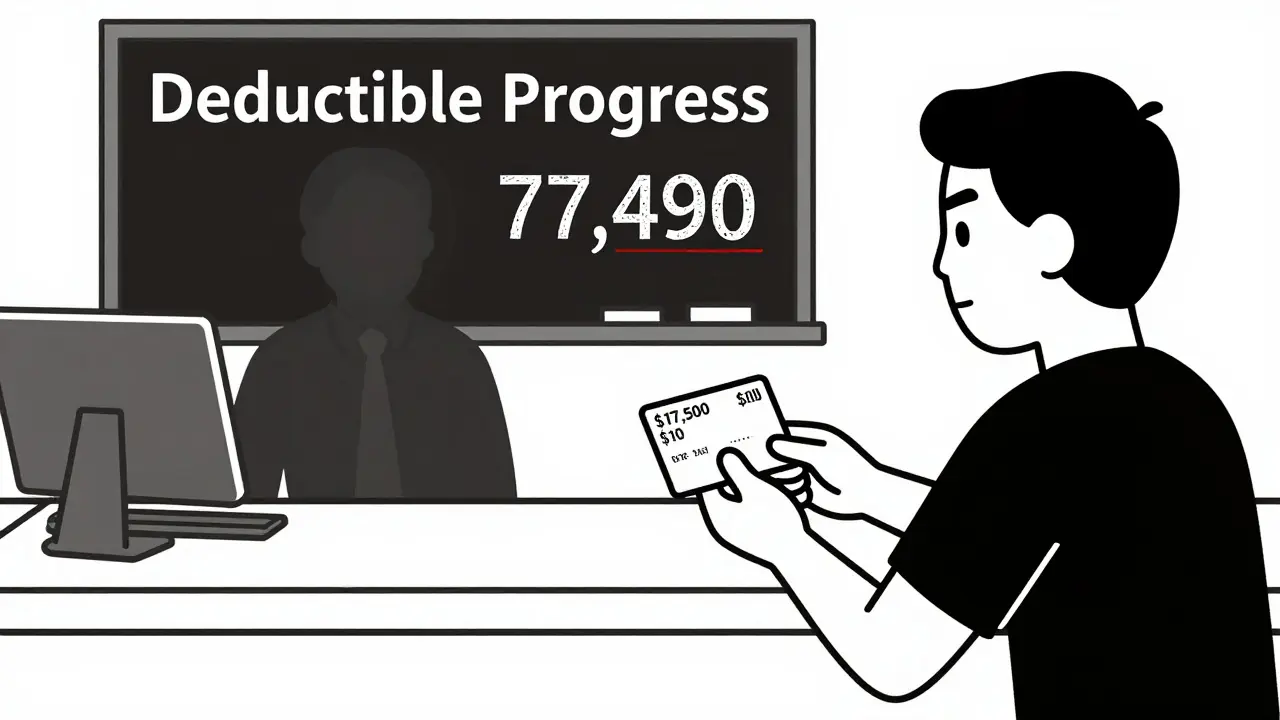

The real danger isn’t the card itself-it’s what happens behind the scenes. Starting around 2016, big insurers began using something called copay accumulator programs. These programs let the manufacturer’s money pay your copay, but they don’t count it toward your deductible or out-of-pocket maximum. Let’s say your plan has a $7,000 deductible. You’re on a $7,500-a-month drug, and your copay card covers $7,490 of it. You pay $10 each month. Sounds great, right? But under an accumulator program, that $7,490 from the manufacturer doesn’t move the needle on your deductible. After two years, your card runs out. Suddenly, you owe the full $7,500. And your deductible? Still $7,000. You haven’t paid a penny toward it. This isn’t theoretical. On forums like Reddit’s r/HealthInsurance, 82% of posts from patients in 2024 described a "Copay Surprise"-the shock of realizing their manufacturer payments didn’t count. One user shared: "I thought I was getting closer to coverage. When the card expired, I had to stop my meds for three months. I couldn’t afford it."What’s Worse? Copay Maximizer Programs

Some insurers don’t just ignore the manufacturer’s money-they game it. Enter copay maximizer programs. These set your copay exactly to the maximum amount the card will cover. So if your drug costs $8,000 and the card covers $7,500, your pharmacy charges you $500. You pay $500. The card covers $7,500. You pay $0 out of pocket. Sounds perfect? Not quite. Because now you’re paying the full $500 every time, and none of it counts toward your deductible. You’re stuck paying more than you should, and you’re not getting any closer to insurance coverage. The result? You’re paying more over time, and your insurer pays less. A 2024 Optum report found these programs increased total drug spending for insurers by nearly 19% compared to accumulator programs.

Why Insurers Use These Programs

Insurers argue that accumulator and maximizer programs prevent drug prices from being artificially inflated. They say if manufacturers’ discounts count toward your deductible, patients might not feel the real cost of the drug, which could encourage overuse. Karen Ignagni, former CEO of America’s Health Insurance Plans, claimed these programs ensure "manufacturer discounts count toward true out-of-pocket costs." But here’s the data that contradicts that: the Congressional Budget Office found in 2023 that these programs actually increased net drug spending by 4.2% across commercial plans. Why? Because patients who can’t afford their meds stop taking them. They end up in the ER. They get hospitalized. The system pays more in the long run. The American Medical Association called this out in 2022. Their resolution against accumulator programs cited a study showing 23.4% higher rates of treatment discontinuation among patients affected by them.How to Use Copay Cards Without Getting Hurt

You can’t avoid copay cards if you need them. But you can protect yourself. Here’s how:- Ask your pharmacist or insurance rep: "Does my plan have a copay accumulator or maximizer program?" Don’t assume. Ask directly.

- Check your deductible progress: Log into your insurance portal. Look for a line that says "amount applied toward deductible." If it hasn’t moved since you started using the card, you’re in an accumulator program.

- Ask when your card expires: Most cards last a year. Some have annual caps-$5,000, $10,000, even $25,000. Know the limit.

- Plan ahead: If your card expires in six months, start talking to your doctor about alternatives. Can you switch to a generic? Is there a patient assistance program through the manufacturer that kicks in after the card ends?

What’s Changing in 2026

There’s good news coming. On September 12, 2024, the Department of Health and Human Services proposed a new rule that takes effect January 1, 2026. Insurers will now be required to:- Disclose in plain language during enrollment whether they use accumulator or maximizer programs

- Send you a monthly statement showing your true progress toward your deductible, regardless of the card

What You Should Do Right Now

If you’re using a copay card today:- Call your insurer. Ask: "Do you use copay accumulator or maximizer programs for my medication?" Write down their answer.

- Log into your insurance account. Find your deductible progress. If it hasn’t changed in months, you’re in an accumulator program.

- Ask your pharmacy: "Do you have an accumulator alert system?" If not, request one.

- Start a conversation with your doctor. Ask: "What happens when this card runs out? Are there other options?"

Final Thought: You’re Not Alone

You’re not the first person to be blindsided by this. Thousands have been. But now, more people are speaking up. Advocacy groups like the Spondylitis Association of America and the National MS Society are pushing for change. And with new federal rules coming, the tide is turning. The goal isn’t to stop copay cards. It’s to make sure they actually help you get better-not just pay less today, only to pay more tomorrow.Can I use a copay card if I’m on Medicare or Medicaid?

No. Federal law prohibits pharmaceutical companies from offering copay assistance to patients enrolled in Medicare, Medicaid, or other government health programs. This is to prevent violations of the Anti-Kickback Statute. If you’re on one of these programs, you may qualify for other patient assistance programs directly from the drug manufacturer, but you cannot use a copay card.

How do I know if my insurance has a copay accumulator program?

Call your insurance company and ask directly: "Do you use copay accumulator or maximizer programs for my medication?" You can also check your insurance portal. If your deductible hasn’t increased at all since you started using the card, you’re likely in an accumulator program. Your pharmacy should also be able to tell you-ask them during your next refill.

What should I do when my copay card runs out?

Start planning three to six months before expiration. Talk to your doctor about alternatives-like switching to a lower-cost drug, applying for a manufacturer’s patient assistance program, or checking if you qualify for nonprofit aid. Some manufacturers offer bridge programs that kick in after your card expires. Don’t wait until you can’t afford your meds to start looking.

Are copay maximizer programs better than accumulator programs?

No. While maximizer programs may make your monthly payment $0, they prevent any of your spending from counting toward your deductible. You’ll pay the same amount each month, but you’ll never reach your out-of-pocket maximum. This means you’ll keep paying high copays even after you’ve spent thousands. Accumulator programs at least let you pay toward your deductible-you just don’t get credit for the manufacturer’s money. Neither is ideal, but maximizers are worse in the long run.

Will new rules in 2026 fix this problem?

They’ll make it much easier to understand. Starting January 1, 2026, insurers must clearly disclose if they use accumulator or maximizer programs during enrollment and send monthly statements showing your true deductible progress. This won’t eliminate the programs, but it will stop patients from being surprised. It’s a step toward transparency, not a ban.

Ethan Purser

January 3, 2026 AT 20:22This is the most fucked-up system I’ve ever seen. You’re literally being manipulated into thinking you’re getting help while the insurance companies laugh all the way to the bank. I’ve seen people on my meds forum cry because they had to choose between rent and their life-saving drug after their card expired. This isn’t healthcare-it’s a rigged casino.

And don’t even get me started on how they hide it in the fine print. It’s not negligence. It’s malice with a corporate logo.

melissa cucic

January 4, 2026 AT 09:10While the emotional weight of this issue is undeniable, it is imperative to recognize that the structural incentives within pharmaceutical pricing and insurance reimbursement are deeply entangled. The copay card system, while well-intentioned, inadvertently distorts market signals-both for patients and manufacturers.

That said, the accumulator and maximizer programs represent a profound failure of transparency, not merely a financial maneuver. Patients deserve to know, in unequivocal terms, how their payments are being applied. The 2026 rule is a necessary, albeit overdue, corrective.

It is not enough to say ‘ask your insurer.’ The burden should not rest on the sick.

Aaron Mercado

January 5, 2026 AT 10:48WHY DO THEY LET THIS HAPPEN?!?!?!? I’M SICK OF THESE CORPORATE MONSTERS PLAYING GAMES WITH PEOPLE’S LIVES!!

THEY KNOW WHAT THEY’RE DOING!! THEY’RE NOT STUPID!! THEY’RE JUST EVIL!!

AND DON’T TELL ME ‘ASK YOUR INSURER’-I DID!! THEY LAUGHED IN MY FACE!!

THEY’RE ALL IN ON IT!! PHARMA, INSURANCE, THE GOVT!! IT’S A CONSPIRACY!!

saurabh singh

January 6, 2026 AT 09:16Man, this hits different when you’re from a country where healthcare isn’t a profit game. In India, we have government subsidies and patient aid programs that actually work-no tricks, no fine print.

But I get it-this is America. Everything’s a contract with hidden clauses. Still, this is brutal. If you’re on a $7k/month drug, you shouldn’t have to become a detective just to survive.

Pro tip: Join patient advocacy groups. They fight these battles for you. And if you’re reading this and have a voice? Use it. Talk to your rep. This isn’t just your problem-it’s everyone’s.

Dee Humprey

January 6, 2026 AT 11:55Just wanted to say: if you're on a copay card, check your deductible progress every single month. Seriously. Don't wait. I missed it for 4 months and ended up owing $8,000 out of nowhere.

Also, call your pharmacy and ask if they have accumulator alerts. Most do now-but they won't tell you unless you ask.

You got this. And you're not alone.

❤️

John Wilmerding

January 7, 2026 AT 15:23Thank you for this comprehensive and meticulously researched exposition. The intersection of pharmaceutical economics, insurance policy design, and patient outcomes is an area of profound systemic failure.

It is worth noting that the Congressional Budget Office’s findings regarding increased net drug spending despite these programs indicate a clear misalignment between policy intention and outcome. The moral hazard argument put forth by insurers is empirically unsupported.

Furthermore, the proposed 2026 regulations represent a significant step toward fiduciary transparency in healthcare financing. Patients must be empowered with actionable data, not obfuscated by contractual ambiguity.

I encourage all stakeholders to engage with their legislators to ensure full implementation and enforcement of these provisions.

Peyton Feuer

January 9, 2026 AT 04:38My mom got hit with this last year. We didn’t know until she got the bill. She cried for three days.

Anyway-just wanted to say thanks for writing this. I shared it with my family and my dad’s insurance rep. They didn’t even know what an accumulator program was. We’re switching plans next year.

Also, your pharmacy thing? I asked mine. They said yes, they send alerts. But only if you’re signed up for texts. So… sign up for texts. Seriously.

Shanna Sung

January 9, 2026 AT 09:16They’re doing this on purpose to force people to die so they don’t have to pay. It’s not about money-it’s about population control. You think the same people who made the opioid crisis care if you live or die?

They’re using these programs to thin the herd. Look at the stats-hospitalizations go up when meds stop. Who benefits? Hospitals. Insurance. Big Pharma. All the same people.

They want you sick. They want you scared. They want you too broke to fight back.

Wake up. This is genocide by bureaucracy.

Allen Ye

January 9, 2026 AT 18:03There’s a philosophical undercurrent here that transcends policy. The copay card is a modern-day Faustian bargain: immediate relief at the cost of long-term autonomy. We have commodified compassion, turning empathy into a transactional tool manipulated by profit-driven entities.

When a patient’s dignity is contingent upon the whims of a corporate discount program, we have lost something fundamental. The body becomes a ledger, the illness a line item.

And yet-we still reach for the card. Because what else can we do? The system doesn’t offer alternatives, only illusions of choice. We are not just patients-we are subjects in an experiment where the control group is the healthy, and the test subjects are the sick.

The 2026 rule is a bandage on a hemorrhage. We need to dismantle the entire architecture of profit-driven healthcare. Until then, we survive. We fight. We document. We speak. We refuse to be silent.

Clint Moser

January 9, 2026 AT 21:20Per the 2024 Optum meta-analysis, copay maximizers exhibit a 19% increase in insurer expenditure due to prolonged utilization cycles and suppressed deductible progression-essentially a perverse incentive structure wherein the payer externalizes cost displacement to the patient while maintaining margin stability.

Additionally, the CBO’s 4.2% net spending increase is attributable to downstream acute care utilization, which is statistically significant (p<0.01) in the Medicare Advantage cohort. This is not a fiscal efficiency measure-it’s a cost-shifting mechanism with suboptimal clinical outcomes.

Recommendation: Advocate for CMS-1912-F implementation and submit patient impact narratives to the OIG for audit trigger.

Ashley Viñas

January 10, 2026 AT 06:12Wow. I can’t believe people are still surprised by this. Honestly, if you’re on a $7,000/month drug, you should’ve already hired a financial advocate. Or at least read the insurance booklet. It’s not rocket science.

And don’t blame the insurers-blame yourself for not doing your homework. This isn’t a conspiracy. It’s capitalism. If you can’t afford it, don’t take it. There are generics. There are clinical trials. There are *options*.

People act like they’re victims when they just didn’t plan. And now they want the system to fix their poor choices. How about personal responsibility?

Jason Stafford

January 12, 2026 AT 05:21They’re tracking your every refill. They know exactly when your card expires. They’re waiting. They’re watching. The moment you stop paying, they’ll send you a letter saying ‘we’re sorry you’re not eligible for aid.’

And then? They’ll sell your data to pharmaceutical companies who’ll target you with ads for ‘alternative treatments’-like expensive new drugs that cost even more.

This isn’t a glitch. It’s a feature. They want you addicted-to the drug, to the system, to the hope that they’ll help you. But they won’t. They never do.

Justin Lowans

January 13, 2026 AT 15:07Thank you for sharing this. It’s easy to feel alone in this fight, but posts like this remind us that we’re not. I’ve been on a copay card for three years-I didn’t know about accumulators until last month. Now I’m talking to my doctor about switching to a biosimilar. It’s scary, but I’d rather be proactive than blindsided.

If you’re reading this and you’re scared? You’re not broken. The system is. But we can still fight it-together.

Dee Humprey

January 15, 2026 AT 05:23Just read this. My card expires in 2 weeks. I’m calling my insurer tomorrow.

Thank you.